THE NEW DEAL ON DATA OWNERSHIP

WHAT’S GOING ON

With more people online than ever before, the growth in wearable technology, sensors and the Internet of Things (IoT), data is being produced at an exponential rate, with some analysts estimating a rate of 50% growth per year.

So, by 2020 people and connected objects are expected to generate 40 trillion gigabytes of data, 10 times the amount generated only a few years ago.

It is no surprise that data has been described as the new currency of the digital world with many companies owing their success to individuals (like you and me) freely giving away our data (most often at no benefit to us).

A recent Gartner report projects that by 2020 as many as 10% of companies will have profitable departments focused on “commercializing” and making money out of the data they collect.

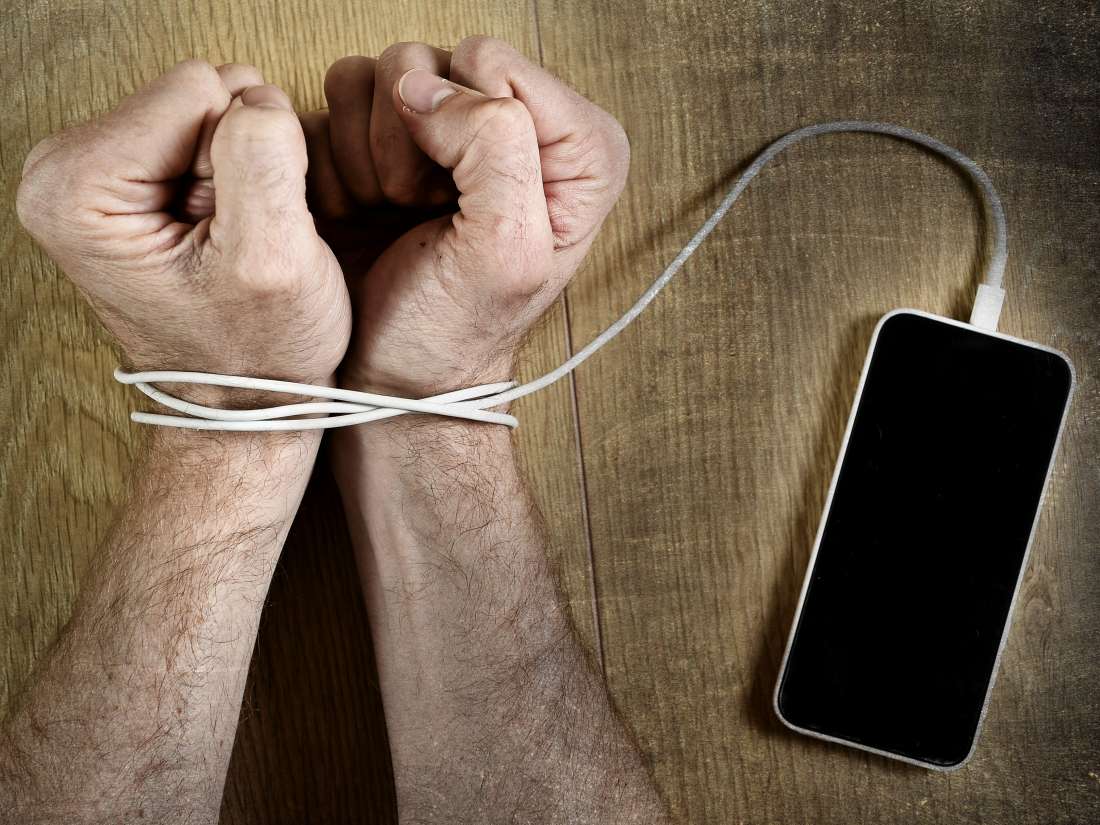

As we become firmly embedded in the digital economy, we are starting to see the first signs of tension between individual ownership of personal data and how institutions utilise our personal data.

This is supported by a study where 78% of people stated that they find it hard to trust companies when it comes to use of their personal data.

In a consumer empowered economy, this tension is stemming along two dimensions:

- The issue of consent. As an increasing amount of personal data is being passively collected by sensors or synthetically generated by algorithms, asking for consent about data the individual knows nothing about becomes problematic.

- Individual benefit. This is an area that is growing in momentum – as early as 2013 more than one new personal data service was launched every week over the year. These included data storage and management services, anonymisation services, identity management and personal analytics.

There are many examples of this potential shift towards ownership of personal data:

- Citizenme, a start-up which allows users to put all their online information together in one place and earn a small fee if they share it with brands.

- Datacoup, also a start-up sells insights from personal data and passes part of the proceedings to the user.

- Internationally, countries like Estonia are creating digital ID systems for citizens which alert them each time a government agency attempts to access their data.

- Last month Microsoft announced plans to use blockchain technology to create decentralised identities for its users meaning greater data protection and ownership for their customers.

- Here in Australia, the federal government has promised to introduce a national ‘consumer data right’ allowing consumers open access to their banking, energy, and telco data. The consumer data right is intended to provide individuals information that will help them compare offers, access cheaper products, and more easily switch to new services.

GROWTH MANTRA’S PREDICTION

- While we don’t expect to see considerable consumer backlash in the short term, we do expect to see more empowered consumers demanding more in exchange for their data – more personalisation and more streamlined systems which will ultimately disrupt a range of industries – particularly traditional banking.

- We are already starting to see individuals taking steps to control their data. An American study found that 86% of Internet users have taken steps online to remove or mask their digital footprints, ranging from cleaning cookies to encrypting their email, avoiding using their name to using virtual networks that mask their IP address.

- As more data is generated, particularly sensitive data such as DNA, we expect this could heighten consumer awareness and education towards personal data. This is quite different to what one may see as the ‘trivial’ data we have been producing through our social media profiles and Internet searches over the last decade in particular.